Search Results for "bond issuance platform"

Bank of Thailand Completes Digital Bond Issuance With Blockchain

Thailand’s apex bank, the Bank of Thailand has leveraged the power of blockchain technology to launch a platform for government bond savings issuance

StanChart and UnionBank of the Philippines Collaborate on PoC of $187 Million Blockchain-Powered Bond

The UnionBank of the Philippines and Standard Chartered have created a proof of concept required in the issuance of a blockchain-powered retail bond.

FUSANG Exchange Announces CCB $3 Billion Digital Bond Listing Suspended

FUSANG exchange announced that the listing of the $3 billion digital bond backed by China Construction Bank has been suspended.

DeFi Broker Porter Finance Shuts Down Bond Issuance Platform

Porter Finance said low lending demand from the DeFi ecosystem has forced it to close its bond trading platform, and mentioned that it now wants to focus on other business opportunities.

First Blockchain National Currency Platform Ready for Central Banks’ CBDC Issuance

The blockchain national currency platform issued by blockchain company Apollo Fintech was finalized and completed on August 12.

Bank of Lithuania Has Commenced the Issuance of its LBCOINS to the Public

Following the launch of its digital collectibles dubbed “LBCOINS,” the Bank of Lithuania has announced that it has commenced the issuance of the LBCOINS to the members of the public. The issuance of LBCOINS is a landmark step in the worldwide drive towards achieving a financial era dominated central bank digital currencies (CBDC).

Thailand Blockchain Community Partners with IBM to Expand $300M Electronic Letter of Guarantee Platform

Thailand Blockchain Community Initiative (BCI) has joined hands with IBM to extend the scope and reach of the blockchain-powered electronic letter of guarantee.

Malaysia's National Stock Exchange Conducts Blockchain PoC to Digitize Bond Market

Malaysia’s national stock exchange, Bursa Malaysia will conduct a blockchain Proof-of-Concept (PoC) dubbed "Project Harbour" to explore the DLT management of the country’s bonds market.

Blockchain-Based Tenancy Platform via REIQ-Igloo Collaboration in Australia

Real Estate Institute of Queensland (REIQ) has partnered with an Australian technology firm, Igloo in setting up a blockchain-based tenancy platform that will propel productivity and efficiency in Queensland's real estate sector.

Mastercard Launches Virtual Platform to Help Governments Test CBDCs

Payment giant Mastercard has unveiled a virtual platform that will enable central banks to assess and explore Central Bank Digital Currencies (CBDCs).

FUSANG Exchange Lists First Publicly Available Blockchain-Based Digital Bond Backed by CCB

Asia’s first digital security exchange FUSANG is partnering with heavy weight China Construction Bank (CCB) to offer the first ever digital, tokenized, blockchain-based bond.

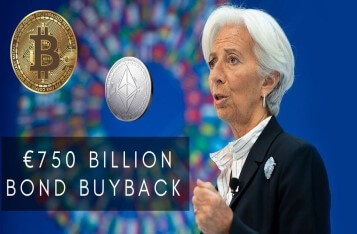

Christine Lagarde Announced EUR 750 Billion Bond Buyback, Bitcoin Surged 10%

With the launch of ECB's €750 Billion bond buyback, Bitcoin, in the last 24 hours witnessed a steep increase in price clocking at 16% growth.